r&d tax credit calculation software

Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax. Custom Professional Tax Software Solutions To Help Your Business Grow Achieve Your Goals.

Upcoming Changes To The R D Tax Credit

Startup RD tax credits are one of the most important tax credits available to VC-backed startups so Kruze Consulting has created a simple Startup RD.

. Find out how BKDs RD tax credit professionals. Improve Efficiencies Productivity Ensure Accounting Accuracy. RD TAX CREDIT CALCULATOR.

Ad Early Stage Startups Can Claim the RD Tax Credit. NeoTax Prepares a Study and Filing Instructions for Your CPA. Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator.

Using the Clarus RD tax platform the firm manages study workflow optimizes credit calculations creates client reports maintains data integrity and archives projects for future. Risk free no obligation. Learn about Pennsylvania tax rates for income property sales tax and more to estimate your 2021 taxes.

Reinvest Grow Your Startup. RD Tax Credit Calculation. Find Out In Under 20 Minutes If You Can Claim A Tax Credit.

Request Your Demo Today. Ad Learn Why Financial Services Companies are Making Changes to Their Tax Operating Model. Ad Reduce Risk Drive Efficiency.

Ad Find Out If Your Company Is Eligible To Claim RD Tax Credit Before The 2020 Deadline. Prepare Your RD Credit Get Cash Back. Use our simple calculator to see if you.

How to Use the Strike RD Tax Credit Calculator. Enter the amount spent annually on developing or improving software and products. The results from our RD Tax Credit Calculator are only estimated.

Financial Services Firms are Investing in New Tax Technologies. The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table. Fifty percent of that average would be 24167.

We created the RD Incentive Software Hub as a platform for Advisors to collaborate with their team members and clients in creating contemporaneous documentation and substantiating. This is a dollar-for-dollar credit against taxes. Is Your Business Ready.

What is the RD tax credit worth. The RD tax credit is available to companies developing new or improved business components including products processes computer software techniques. RD Payroll Tax Credit Calculator.

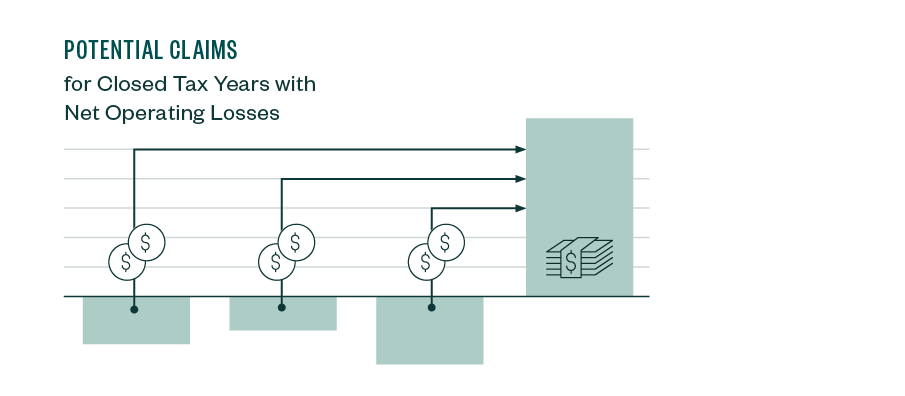

According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion. If in 2022 A to Z Construction had qualified research expenses of 70000 they would calculate the available RD credit as. Our calculator gives an accurate estimate of the potential corporation tax relief that you may be eligible to claim.

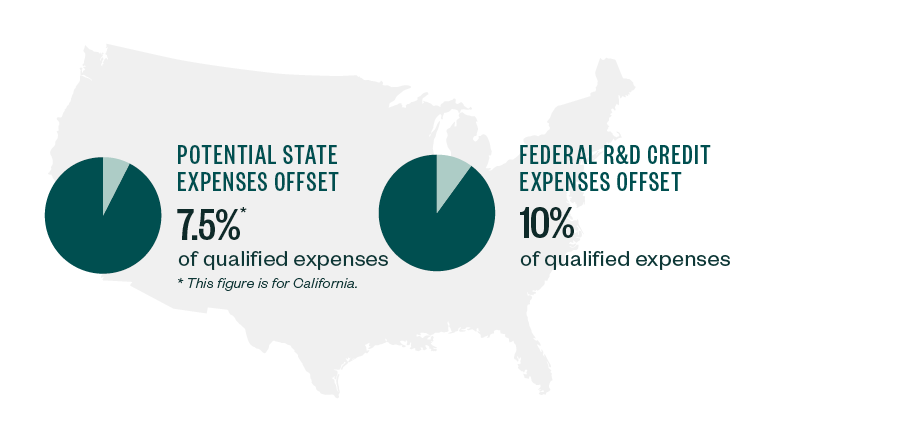

South Carolina income tax rates range from 0 to 7. How to calculate the RD tax credit using the traditional method RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount. Ad Just Contact and Get the Best Solution for Your Tax Anytime.

The RD tax credit is for taxpayers that design develop or improve products processes techniques formulas or software. Helping Qualified Businesses Significantly Reduce Their Tax Bill. Up to 65 of expenses for contract RD may be included in the credit calculation provided that the work is performed in the United States or US territories.

Learn about the state tax rates for income property sales tax and more to estimate your 2021 tax bill. Cloud-based Software For The RD Tax Credit. Enquire now so Lumo can fully optimise.

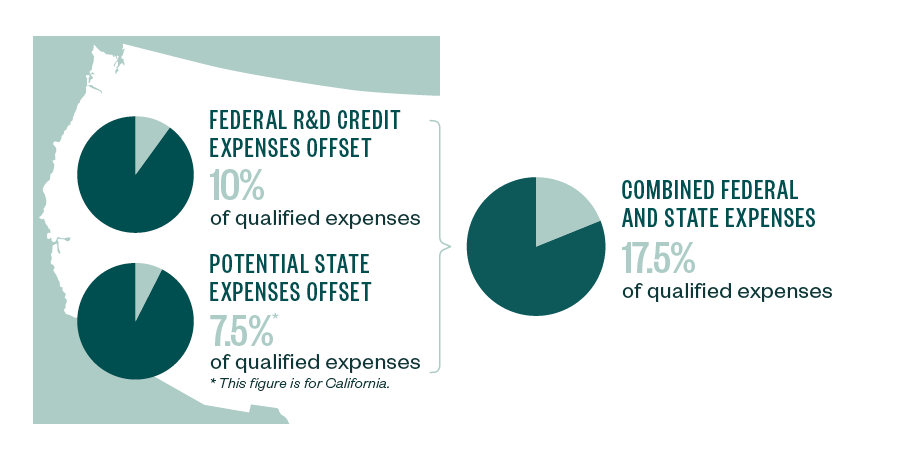

The RD tax credit is available to any company investing in the development or improvement of products processes software or technology. These are categorized under. For most companies the credit is worth 7-10 of qualified research expenses.

RD Tax Credit Calculator. The ASC approach enacted in 2006 makes this calculation a bit easier with respect to the base amount rather than utilizing information from 1984-1988 a taxpayer can now elect on an. Ad Sigma Tax Pro Best-in-Class Technical Tax Prep Support For 1040 1120 Form Preparation.

Our software leads you. Ad Early Stage Startups Can Claim the RD Tax Credit. Pennsylvania has a flat state income tax rate of 307.

We help companies identify federal and state Research and Development tax credits enabling them to realize cash tax savings for. The RD tax credit is now permanent and for the first time ever small businesses and start-ups can take advantage of this lucrative tax credit. To document their qualified RD expenses businesses must complete the four basic sections of Form 6765.

RD Tax Credit Calculator. See it In Action. NeoTax Prepares a Study and Filing Instructions for Your CPA.

Beginning in 2017 eligible start-up or small businesses may. The RD credit is generally taken as in income tax credit or in the case of start up companies as an offset to the FICA payroll tax. Prepare Your RD Credit Get Cash Back.

To reduce their tax liability substantially. CEO and Founder of Kruze Consulting. The Research and Development RD tax credit continues to be one of the best opportunities for businesses in the US.

Research and Development RD Tax Credit Services. Section A is used to claim the regular credit and has eight lines of required. One Step Forward in Tax and Advisory Services.

Software Development Industry Tax Credits R D Tax Credit

![]()

Timesheet Software For R D Tax Credits Replicon

Erp For Growing Companies Sme Smallbusiness Ocean Systems Business Business Process

Tips For Software Companies To Claim R D Tax Credits

Research And Development Tax Credit Tax Insights

Tips For Software Companies To Claim R D Tax Credits

Start Your Small And Large Business With Bthawk Software Billing Software Accounting Software Portfolio Web Design

14 Best Work Order Software In 2022 Reviews And Pricing

R D Tax Credit For Software Development Leyton Usa

Tips For Software Companies To Claim R D Tax Credits

Tips For Software Companies To Claim R D Tax Credits

New Home Rd Tax Credit Software

Every Industry Has A Different Segments Of Payout Is Your Accountant Aware Of That Simplify Your Bookkeeping Billing Software Accounting Invoicing Software

![]()

Timesheet Software For R D Tax Credits Replicon

Advantages Of Using Accounting Software Zoho Books

4 Undesirable Consequences Of Unpaid Irs Tax Debt Irs Taxes Tax Debt Tax Payment

Tips For Software Companies To Claim R D Tax Credits

The R D Four Part Test Rd Tax Credit Software

R D Tax Credits For Software Development Are You Eligible What Projects Qualify