child tax portal update dependents

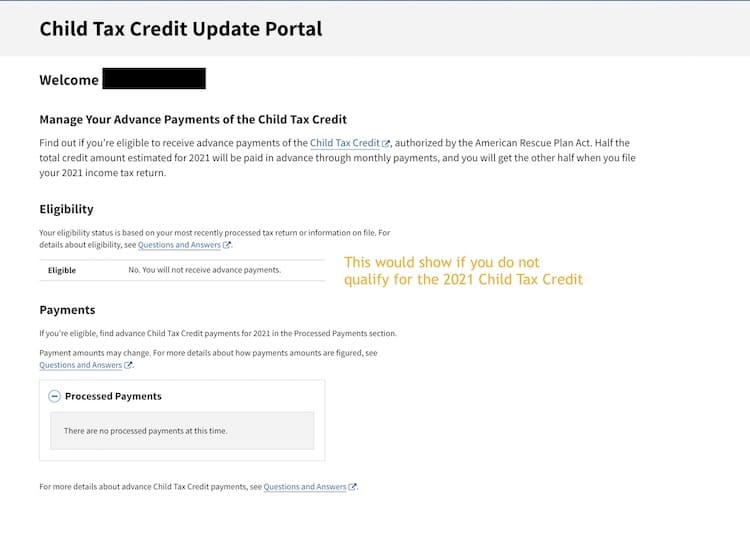

The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment. This means that instead of receiving monthly payments of say 300 for your 4-year-old you can wait until filing a 2021 tax return in.

2021 Child Tax Credit Steps To Take To Receive Or Manage

The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children.

. COVID Tax Tip 2021-167 November 10 2021 The IRS recently launched a new feature in its Child Tax Credit Update Portal allowing families receiving monthly advance child tax credit payments to update their income. That means that instead of receiving monthly payments of say 300 for your 4-year. Half of the money will come as six monthly payments and.

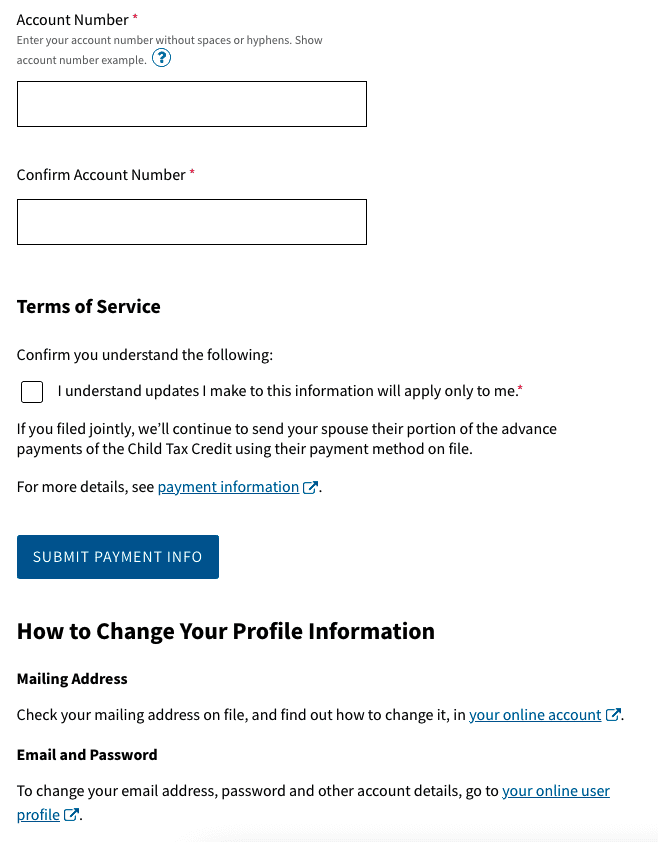

Both the Child Tax Credit Eligibility Assistant and Child Tax Credit Update Portal are available now on IRSgov. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments.

The IRS will pay 3600 per child to parents of young children up to age five. The American Rescue plan increased the maximum Child Tax Credit amount in 2021 to 3600 per child for children under the age of 6 and to 3000 per child for children ages 6 through 17. The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments.

You can use it. The IRS will pay 3600 per child to parents of young children up to age five. Get your advance payments total and number of qualifying children in your online account.

Heres how they help parents with eligible dependents. Families should enter changes by November 29 so the changes are reflected in the December payment. The tool also allows families to unenroll from the advance payments if they dont want to receive them.

The Child Tax Credit Update Portal allows people to unenroll from. To reconcile advance payments on your 2021 return. Half of the money will come as six monthly payments and.

You can also refer to Letter 6419. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. You may be eligible for a child tax rebate of up to a maximum of.

If Married Filing Jointly If Letter 6419 Has a Different Advance Payments Total. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. The Update Portal is available only on IRSgov.

Enter your information on Schedule 8812 Form 1040.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

2021 Child Tax Credit Steps To Take To Receive Or Manage

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Dependent Children 2021 Tax Credit Jnba Financial Advisors

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update Next Payment Coming On November 15 Marca

2021 Child Tax Credit Steps To Take To Receive Or Manage

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor